True ECN Forex Brokerage Conditions

Unbeatable Institutional ECN Market Access

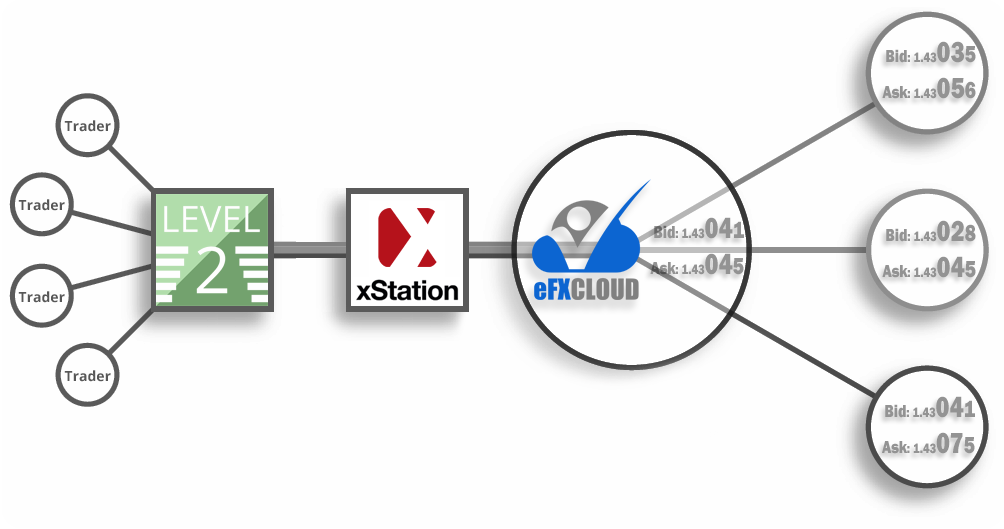

Level 2 Forex Order Flow

Level 2 Forex leverages institutional relationships to provide individual traders with access to professional aggregated liquidity via the eFX Cloud network.

Leverage & Margin

| Account Size | Leverage | Margin Requirement |

|---|---|---|

| Below 10,000 | 1:1000 | 0.1 % |

| 10,000 to 500,000 | 1:500 | 0.2 % |

| Over 500,000 | 1:10 | 10 % |

Account Minimums, Specifications and Fees

| Minimum Initial Deposit | 100 USD or Equivalent |

| Minimum Trade Size | 1 Micro Lot (0.01 Lot, 1000 units of base currency) 0.10 of quote currency per pip |

| ECN Commissions | Remove Liquidity: $0.025 USD per Micro Lot * Add Liquidity: -$0.012 USD per Micro Lot (Get paid for limit orders filled) |

| Account Currency | USD / EUR / GBP / JPY / CAD / AUD / NZD |

| Spreads | No Dealing Desk ECN (Extremely Tight ECN market quotes from aggregated liquidity pool, varies depending on interbank market conditions) |

| Currency Price Quote Type | Fractional Pips (5 decimals on non-JPY pairs, 3 decimals on JPY pairs) |

| Level 2 Order Book for Forex | YES |

| Trading Software | Level 2 Trader Pro (WEB) |

| Monthly Software Fees | NONE |

| Monthly Live Data Fees | NONE |

| Account Maintenance Fees | NONE |

| Inactive Account Fees | NONE |

| Margin Call | 50 % of Margin Requirement ** |

| Margin Stop-Out | 30 % of Margin Requirement *** |

| Demo Account | FREE |

NOTES

* Commission fees are calculated per side. For example, 0.02 per side is 0.04 per round-turn

(open trade plus close trade).

Remove liquidity means any time you place a market order (or stop order that becomes a market order) that is filled

on our ECN. The positive number listed means that is the amount you are charged for removing liquidity, the

normal structure of commissions for retail.

However, unlike other retail brokers, we offer ECN rebates (similar to the pricing of many ECN venues in

direct access stock exchanges which are rarely offered to retail participants.)

The negative commission for adding liquidity means that we pay you the amount when your limit orders are

filled. These are conditions normally only offered to institutions. We offer it for all account sizes.

** Margin Calls are requests for additional deposit in order to maintain losing positions

below the margin call requirement level. At 50% of margin requirement, the system allows

traders room to make use of leveraged trades while still issuing a final warning if margin

falls below this level.

*** At the Margin Stop-Out level, trades are automatically closed in order to prevent negative

balances. The system is designed to protect against negative balances within all reasonable

circumstances. However, due to the nature of providing a true ECN liquidity environment, the

system cannot guarantee against negative balances during "black swan" events.

In any case, we will not pursue negative balance amounts owed by traders.